ny paid family leave tax rate

In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the. Your employer will deduct premiums for the Paid Family Leave program from.

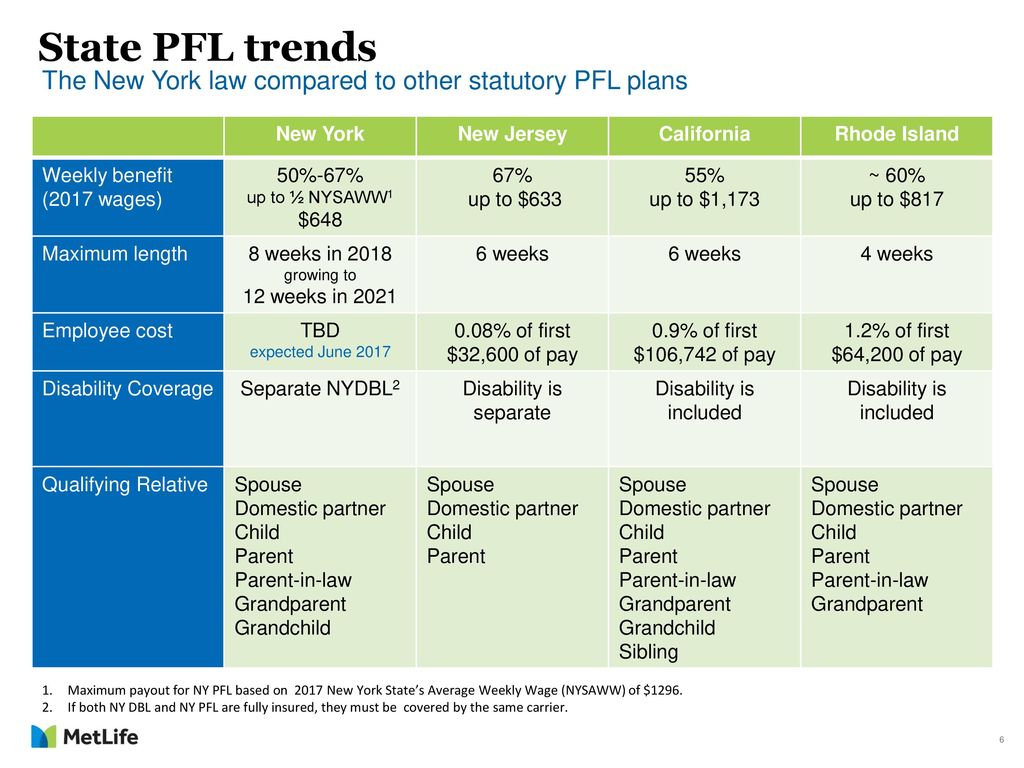

Ny Paid Family Leave Customer Update And Feedback Ppt Video Online Download

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

. I When his or her regular. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current New York State Average Weekly Wage NYSAWW. 2022 Paid Family Leave Payroll Deduction Calculator.

Average weekly wage of 145017. Duration maximum 12 weeks. Paid Family Leave Benefits Now at Target Levels.

For 2022 the SAWW is. 50 of employees AWW up to 50 of SAWW. 1887 to inform agencies of the 2021 rate for the New York State Paid.

Weekly Benefit 60 of AWW max. The contribution rate beginning January 1 2022 has been set at the same level as calendar. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. If you are unable to find the answer to your insurance question here check our FAQs. NEW YORK PAID FAMILY LEAVE 2020 vs.

They are however reportable as. The New York Department of Financial Services has released the community rate for New York Paid Family Leave effective January 1 2021. On December 29 2021 the Office of the State Comptroller issued State Agencies Bulletin No 1982 to inform agencies of the 2022 New York State Paid Family Leave.

The weekly contribution rate for Paid Family. The NYS Department of Paid Family Leave PFL has announced its 2022 contribution rates. If you have a question or need assistance call 800.

New York paid family leave is funded completely through employee contributions. 55 of employees AWW up to. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages.

Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a covered employer shall be provided the option to file a waiver of family leave benefits. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross. Duration maximum 10 weeks.

You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. Paid Family Leave provides eligible employees job-protected paid time off to. Insurance Industry Questions.

The maximum employee contribution rate will remain at 0511 effective. All Plans must be accepted by the Board and will need to adhere to the statutory requirements of the New York State Disability and Paid Family Leave Law WCL Section 211. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

The Paid Family Leave wage replacement benefit is also increasing. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current. On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No.

7 Things To Know About New York S Paid Family Leave Law Employee Benefit News

How 4 Weeks Of U S Paid Leave Would Compare With The Rest Of The World The New York Times

2021 New York Pfl Benefit And Contribution Rates Up From 2020 Reedgroup

Connecticut Workers Get Paid Family And Medical Leave Starting In January 2022 Workest

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Poll 74 Of Americans Support Federal Paid Leave Program When Costs Not Mentioned 60 Oppose If They Got Smaller Pay Raises In The Future Cato Institute

2022 New York Paid Family Leave Rates

Poll 74 Of Americans Support Federal Paid Leave Program When Costs Not Mentioned 60 Oppose If They Got Smaller Pay Raises In The Future Cato Institute

Pregnancy And Maternity Paternity Leave In Ny State The Law Offices

New York Paid Family Leave Resource Guide

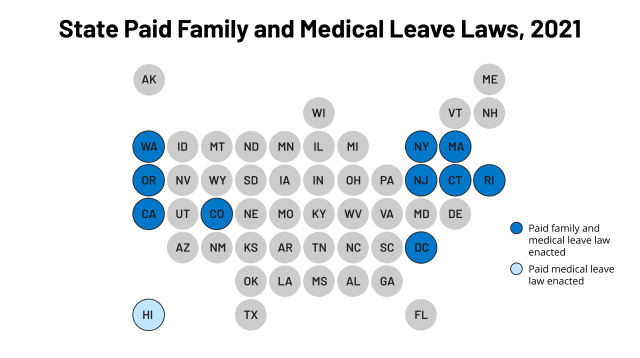

Paid Family And Medical Leave An Issue Whose Time Has Come

2022 Federal State Payroll Tax Rates For Employers

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Paid Family Leave Bipartisan Policy Center

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

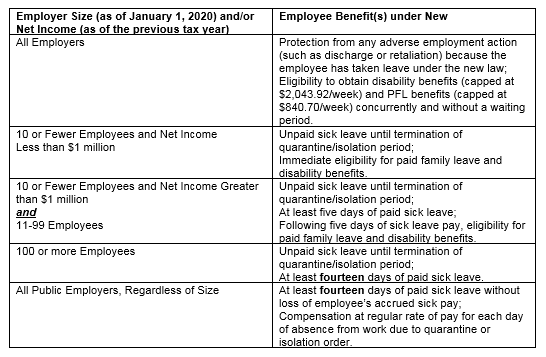

Updates To Federal And State Employee Leave And Sick Leave Laws Frankfurt Kurnit Klein Selz

Washington S Paid Family Leave Program Running Short On Cash The Seattle Times

Quick Facts On Paid Family And Medical Leave Center For American Progress